Friday, April 1, 2011

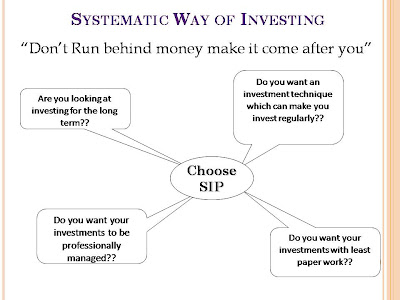

Systematic Investment Plan

Labels:

Investor Awareness,

Mutual Fund,

Smart Investments

Power of Compounding and Your Retirement

The power of Compounding in layman terms states that the more you hold an investment the more is your return.

| Power of Compounding for Rs. 5000 Monthly Investment | |||||

| | | Returns @ | |||

| Number of Years of Investment | Amount Invested | 6% | 9% | 12% | 15% |

| 5Year | 300,000 | 350,000 | 379,943 | 412,402 | 448,348 |

| 10 Years | 600,000 | 823,508 | 974,818 | 1,161,641 | 1,393,158 |

| 15 Years | 900,000 | 1,461,384 | 1,906,203 | 2,522,781 | 3,384,046 |

| 20 Years | 1,200,000 | 2,321,783 | 3,364,455 | 4,995,559 | 7,579,206 |

| 25 Years | 1,500,000 | 3,482,332 | 5,647,613 | 9,487,848 | 16,419,171 |

| 30 Years | 1,800,000 | 5,047,738 | 9,222,309 | 17,648,974 | 35,046,578 |

Look how a monthly Investment of 5000 can work upto in 30 years even with 6% return on investment. so all i am advising here is to be disciplined in your investments.

For people who plan to retire my suggestion is too start as early as possible as the more time your investments remain invested more is your return. I have shown a simple example where in which two investors who start at different time frames their investments. The person who starts early need to keep away only a small portion of money. The other person decides to start with almost double but he still can't catch up with the guy who starts early.

If your goal is to retire at the age of 60 with 50,00,000 and you assume an 8% return, how much will you need to invest Monthly?

| Ramu | Shamu | ||

| Amount required | 5,000,000 | Amount required | 5,000,000 |

| Expected Rate of Return | 8% | Expected Rate of Return | 8% |

| Age | 60 | Age | 60 |

| Current Age | 35 | Current Age | 45 |

| Monthly Payment | 5,257 | Monthly Payment | 14,449 |

Here you need to appreciate the fact that because Ramu started saving early he need to save only a small amount to reach 50 Laks by Age of 60. Where as shamu did not start early and to make up his 50 lak he now needs to invest more than double the amount of what Ramu is investing.

Key Takeaway - Start Early Save Regularly for a tension free Retirement Life.

Key Words: Power of Compounding, Monthly payment, SIP Calculator, Retirement, Savings, Pension

Debt Quick Reference, Ready Reckoner, Debt Market Abbreviations

National Stock Exchange of India Ltd.

Wholesale Debt Market Segment

Legend for Daily Market Reports

Traded Securities on WDM Segment :

1. Security Type : The instruments issued by various issuers are clubbed under different homogeneous categories which are known as Security Types.

2. Security: Security indicates either issuer name or year of maturity or term of the instrument, depending upon nature of the instrument.

Suffixes such as A, B etc. to the security name have been given purely for the purpose of differentiating various securities issued by the same issuer and maturing in the same year and carrying the same coupon rate.

3. Issue: Issue indicates either maturity date, coupon rate or mark-up rate over benchmark depending upon nature of the instrument.

Explanation of Security and Issue for different types of instruments is given hereunder.

Sr. No | Type of instrument | Security Indicates | Issue Indicates | Example |

1 | T-Bills | Term of T-bills - 91 days, 364 days | Date of maturity | “TB 364D 160503” stands for Treasury Bill issued for 364 days and maturing on |

2 | Discounted instrument other than T-bills | Issuer | Date of maturity | “CP HDFC 061202” stands for Commercial Paper issued by HDFC Limited maturing on |

3 | Coupon bearing instruments including zero coupon instruments | Issuer and year of maturity. | Coupon rate | · “GS CG2012 7.40%” stands for Govt. dated security, issued by the Central Govt. and maturing in 2012 carrying a coupon of 7.40%. ) “PT IRFC07 8.05%” stands for taxable PSU bonds issued by the IRFC maturing in 2007 carrying a coupon rate of 8.05%. |

4 | Floating rate instruments | Issuer and year of maturity. | Mark-up over benchmark | “GF CG2017 +0.34%” stands for Floating Rate Bond issued by the Central Govt. maturing in 2017 with a mark-up of 0.34% over the benchmark. |

4. Weighted Yield To Maturity: Weighted yield to maturity (YTM) indicated for the traded security is calculated on the basis of all trades done in the security during the day. The formula used for calculation is given below:-

Weighted YTM = sum (Traded Value*Yield to Maturity) / sum (Traded Value)

5. Value Weighted Average Price / Rate: Value weighted average price indicated for the traded security is calculated on the basis of all trades done in the security during the day. The formula used for calculation is given below:-

Value Weighted Average Price = sum (Traded Value*Traded Price) / sum (Traded Value)

6. Government Securities: The instruments which are issued by Central Government and State Government are clubbed under the category of Government Securities.

7. Non-Government Securities: The instruments for which issuer is other than Central Government and State Government are clubbed under the category of Non-Government Securities.

List of Security Types | ||

Issuer | Description | Regular |

Central Government | Compensation Bond | GD |

Converted Stock | GC | |

Floating Rate Bond | GF | |

GOI Dated Securities | GS | |

Partly Paid up Loan | GP | |

Treasury Bill | TB | |

Zero Coupon Bond | GZ | |

Index Bond | GI | |

State Government | Development Loan | SG |

Tax-Free Power Bond | SP | |

Taxable Power Bond | SX | |

Local Bodies | Municipal Taxable Bond | MT |

Statutory Corpn. Taxable Bond | TS | |

Statutory Corpn. Tax-Free Bond | SF | |

Municipal Tax-Free Bond | LF | |

Public Sector Unit | Promissory Note | PD |

Taxable Bond | PT | |

Tax-Free Bond | PF | |

Zero Coupon Bond | PZ | |

Cumulative Bond | PE | |

Infrastructure Bond | PI | |

Floating Rate Bond | PR | |

Institutions | Floating Rate Bond | FB |

Non-SLR Bond | ID | |

SLR Bond | IB | |

Zero Coupon Bond | IZ | |

Deep Discount Bond | DI | |

Tax-Free Bond | IF | |

Supra-Instititutions | Deep Discount Bond | FD |

Tax-Free Bond | FF | |

Promissory Note | FP | |

Floating Rate Bond | FR | |

Taxable Bond | FT | |

Zero Coupon Bond | FZ | |

Banks | Bond | BB |

Certificate of Deposit | CD | |

Floating Rate Bond | BF | |

Zero Coupon Bond | BZ | |

Perpetual Bond | BP | |

Corporate | Commercial Paper | CP |

Debentures | DB | |

Promissory Note | CN | |

Deep discount Debentures | DC | |

Securitized Debt | SD | |

Floating Rate Debenture | CF | |

Infrastructure Bond | CI | |

Mutual Funds | Unit 64 | US |

Mutual Funds units | MF | |

Mutual fund cumulative | MC | |

Subscribe to:

Comments (Atom)